Dear Pieter,

Giving up (tax) residency as a simple Dutch guy on income took me 15 minutes.

But you are currently running a business. Then it gets very complicated fast.

The problem is that in the Netherlands when you move abroad for the tax man it will considered as if you sold your business (“fictieve vervreemding”).

According to the links below an SP (“eenmanszaak”) will have to be liquidated when you migrate.

Enige artikelen over verhuizen eenmanszaak.

http://www.vanlieradvies.nl/emigreren/emigreren-onderneming.html

http://zweden.placement.nl/default.aspx?menu=251&id=2435

There will be a valuation on what is considered the current market value of your business. This includes things like Intellectual Property that you are currently creating with all your different projects and websites and “goodwill” you have as a person. You need to have this valuated and documented. If you do not do it and end up in a dispute, the tax man will make an estimation and this will NOT be in your favor.

The sour part of it is that as a SP you are only considered for one tax. And that is income tax (up to 52%). And this bracket WILL be reached when you sell your business. (It was already reached when I got a one month salary Christmas bonus with my last job).

You should really start working on getting incorporated. Not just for tax reasons, but you are now just to vulnerable. Doing international business with a SP is simply not a good idea.

What I would do?

It is not as easy. I thought a first step could be to transfer the Eenmanszaak to a (flex) BV. But bummer, the claim of the tax man will remain on the current “stakingswinst”. It might be a thing to consider anyway.

This is interesting: http://www.higherlevel.nl/extra/columns/view/98

Second thought. Set up an offshore company that will hold your Intellectual Property and invoices the Dutch SP and drain all the profit. Like multinationals do it. I do not know the situation enough to see if this would even make any sense. And if you run that company and remain resident in the Netherlands it solves very little.

Third thought. At least something that you definitely should do. Start all your new ventures from an LLC. Preferably offshore. And make sure they have a permanent establishment outside of the Netherlands. Income will still be taxed but at least you can start to use tax plannign tools.

It looks like you will have to bite in what we in NL call a “sour apple”.

And the longer you wait, the more headaches and “fair share” it will take.

Now, you mention that you do not want to make yourself a target. This will automatically happen when you mention the word immigration to the tax authorities.

The Dutch tax authorities are not a “happy” bunch. I have seen them really mess people up as soon as they found a mistake.

Make sure you have everything in order.

…They just hate to see you go…

It is interesting that you pay up to 52% of your entire income and not already feel yourself a target.

But that must be the “Anti-Tax libertarian Anarchist” in me (ha!)

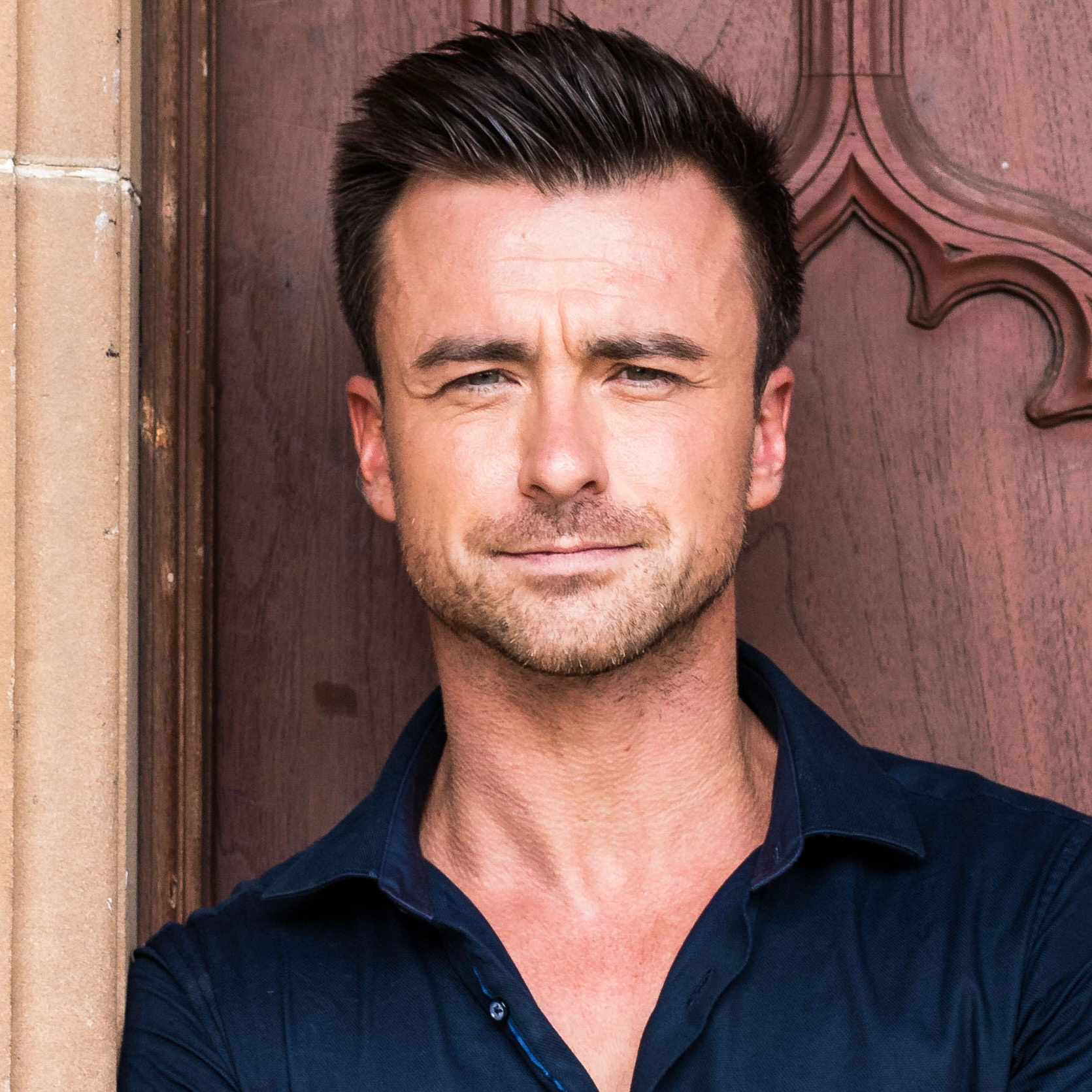

Godspeed,

My fellow digital nomads.

And let us ride the tax free waves of international epic-ness (hurray!).

p.s. let me know when you have questions. Although I will be traveling the coming days.